In Accordance to a 2023 report by PeopleKeep, small businesses provided a median monthly advantage of $319 for self-only employees and $457 for workers that have been married with a family. Your team may even need to stay organized and maintain onto information and receipts. As Quickly As we do the first one collectively, you’ll really feel tremendous confident going ahead. You can use spreadsheets or different software program to trace and store this data, but be mindful of your employees’ privateness in addition to normal safety procedures. Laura is a contract author specializing in small business, ecommerce and way of life content.

I need to know the method to set up a payroll item for QSEHRA that both records the amount for the employee’s W-2 and likewise applies reimbursement the quantity to the paycheck. You’ve Got decided to reimburse your workers tax-free with a QSEHRA. Whereas most reimbursements via QSEHRA are tax-free, there is one type of allowable reimbursement that should be taxed.

Glad to know my colleague provided the helpful info, Waterma. I’m here to assist you set the reimbursement and distribute the funds correctly. A sole proprietorship is an unincorporated enterprise owned and run by one particular person. By regulation, there’s no defined separation between the enterprise and its owner.

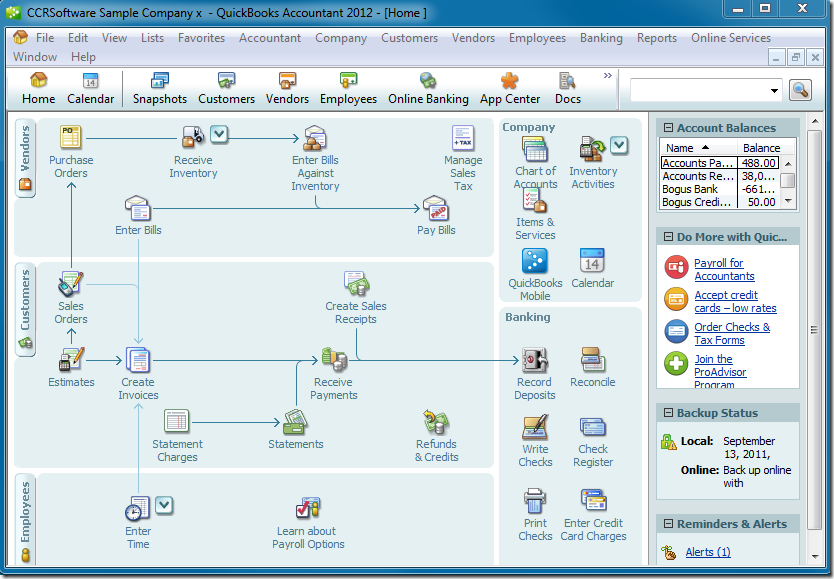

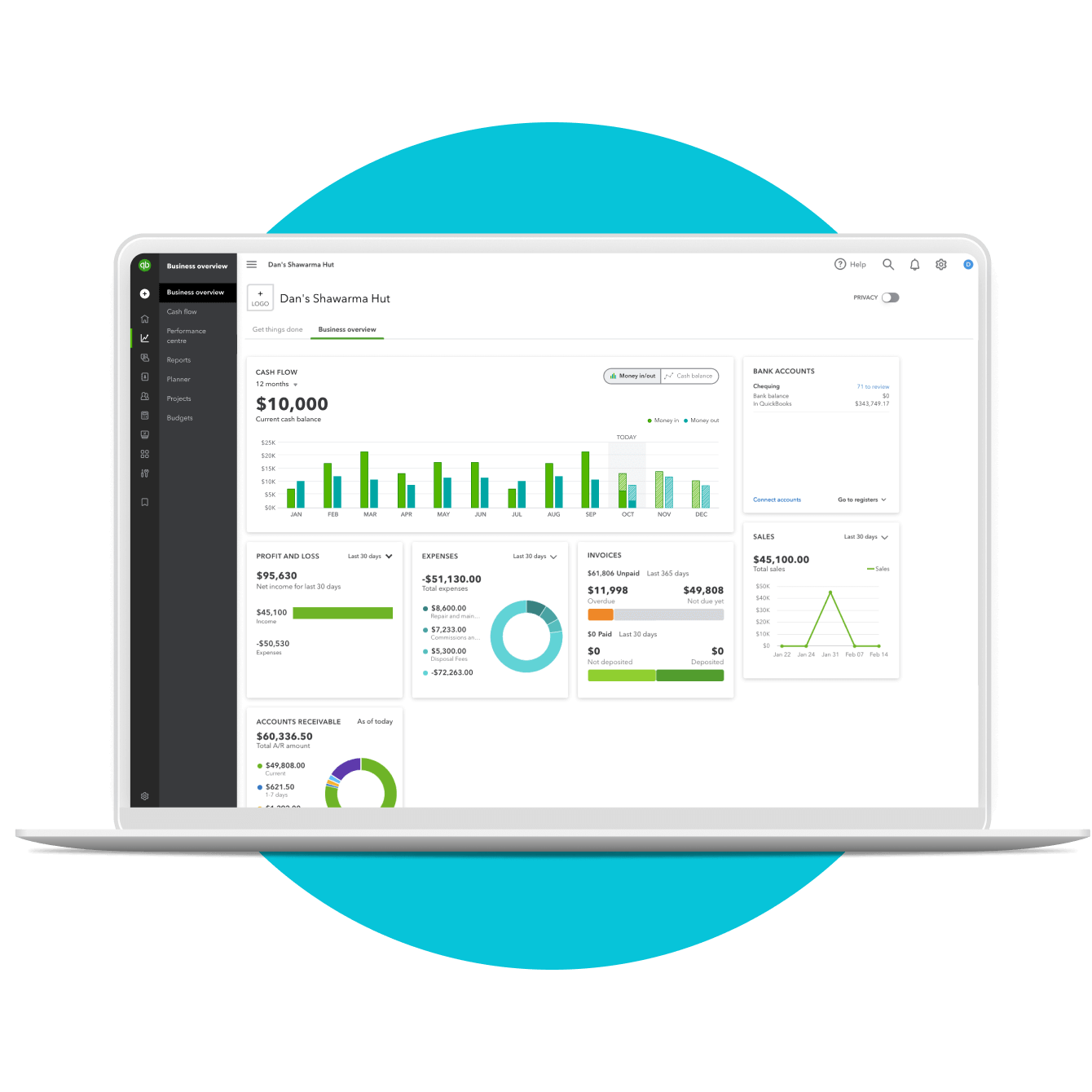

Any amounts tracked with the new tax-tracking sort might be reported as required on Field 12 of Kind W-2 code FF. Employers can set how much they need to contribute (up to the utmost amounts, discussed later) and there are never any increases until the employer wants to increase the quantity. QSEHRA is a means more budget friendly answer for small companies and non-profits. I just called support as well they usually had no idea the way to direct this reimbursement to field 12 line FF on the W2. As Soon As done, if you create the paycheck, the item will be added mechanically.

Right Here is a bit more info on reimbursing your employees instantly through payroll. newlineI have entered the data in field 12FF as instructed however it doesn’t quickbooks qsehra show up on certainly one of my employees W-2 once I go to print it. I really have another worker with a Easy IRA deduction as nicely as the QSEHRA and it does show up correctly on his W-2. Once accomplished, replace the accounting preferences to ensure the reimbursement quantities shall be posted to the right account. Once done, I advocate updating your accounting preferences to ensure the reimbursement amounts are posted to the proper account.

Am I In A Position To Reimburse Employees For Well Being Insurance?

Particularly, any expense thought-about a taxable reimbursement should be included as different taxable earnings in box 1 with their wages, ideas, and different compensation. Organizations using an HRA save an average of 27% for single plans and 52% for household coverage2 compared to organizations that only use a gaggle medical insurance plan. If you set limits up then it’ll cease at that line and not allow any extra amounts to be reimbursed. You can deal with a month-to-month dump in and a yearly prime limit or you’ll be able to set the whole restrict in and allow them to spend all of it at one time and hope they don’t stop before the tip of the year.

- Medicare is for individual insurance, and the GCHRA solely works with employer-sponsored group well being plans, making them incompatible.

- That expertise provides her a unique understanding of how the consumer-focused content material she writes flows into every marketing piece.

- Plan documents aren’t solely a good suggestion, they’re truly required.

- The tax financial savings will probably end in everyone taking home extra money.

- Organizations utilizing an HRA save a median of 27% for single plans and 52% for family coverage2 compared to organizations that solely use a group medical insurance plan.

In this text, we’ll walk you through the steps required to efficiently supply a QSEHRA, making certain that each you and your workers profit from this progressive strategy to well being benefits. Your organization makes QSEHRA payments on a tax-free basis for each the group and the staff. During tax time, use field 12, code FF on each employee’s W-2 to report the total permitted benefit out there to the worker by way of the QSEHRA. By this level, you’re done with the prep work and formally https://www.quickbooks-payroll.org/ able to administer your QSEHRA!

The largest timing issue is Open Enrollment for particular person well being plans which runs from November 1st to December fifteenth in most states. Some states have an extended Open Enrollment interval but December fifteenth is usually the deadline for individuals to purchase a well being plan that may start on January 1st of the next yr. Employees will pay the insurance coverage firm or doctor’s office directly after which submit a claim to get reimbursed for their bills tax-free. Intuit also has a novel monitoring code for QSEHRA reimbursements.

Assist Workers Purchase Individual Medical Well Being Insurance Policies

But it must be managed responsibly for the benefit to truly ship worth. Fortunately, an HRA administrator might help you should you don’t wish to do it yourself. QSEHRA payments are tax-free to you and your workers, supplied they have MEC. Whereas you want to ask if they have MEC to obtain tax-free reimbursements, in the occasion that they don’t have MEC, they’ll must pay taxes on the quantity they receive. You’ll also have to add any reimbursement payments you made to your employees’ W-2 as gross earnings if they are saying they don’t have MEC. Your organization should spend money on your employees’ success with your QSEHRA by offering them with sources to grasp and store for a person plan.

One of the main perks of HRAs—including the qualified small employer HRA (QSEHRA)—is their tax advantages. This means employers get to offer benefits in a tax-efficient manner with out the hassle or headache of administering a conventional group plan and workers can select the plan they want. This new model of advantages allows employer contribution to health insurance that fits their price range and their employees’ wants. As the business proprietor or plan administrator, you’ve some options and get to make the choice! Remember, the tax-free nature of the QSEHRA as a small business medical well being insurance option comes from having your plan documents in place, staying compliant, and having the proper year-end reports.

For instance, it’s unlikely that you’ll be in a position to draft a plan document with out the help of an attorney—that cost2 alone can exceed $3,000. Even if you are going to buy pre-written plan paperwork, you’re nonetheless looking at charges of $200 or extra, and the document seller wouldn’t be available to help with any plan amendments. The plan sponsor must certify that employees’ health data will be protected and never used for employment-related actions. This doesn’t involve advising your staff on which insurance policies to purchase.