Understanding the Correlation Between Crypto Markets and Traditional Markets

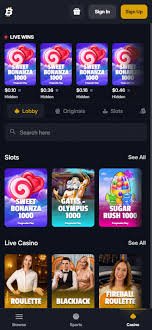

The correlation between crypto markets and traditional financial markets has been an area of intense scrutiny and debate among investors and economists alike. With the rise of cryptocurrencies like Bitcoin, Ethereum, and others, many have begun to question how these digital assets perform in relation to more conventional investments like stocks and bonds. In this article, we will explore this correlation, drawing insights and making comparisons to help investors better navigate their strategies in both realms. Additionally, we will highlight some interesting trends observed between the Correlation Between Crypto Markets and Betting Volume https://bitfortunebet.com/slots/ worlds of crypto and traditional finance.

The Evolution of Crypto Markets

Cryptocurrencies emerged in the wake of the 2008 financial crisis, presenting themselves as decentralized alternatives to traditional fiat currencies and financial systems. Bitcoin, the first cryptocurrency, was introduced in 2009 by an anonymous figure known as Satoshi Nakamoto. Since then, the crypto market has expanded to include thousands of digital currencies, fostering a new economy that operates largely independently of traditional financial institutions.

The Nature of Correlation

Correlation, in financial terms, measures how two assets move in relation to one another. A correlation of +1 indicates that the assets move in perfect tandem, while a correlation of -1 indicates that they move in opposite directions. A correlation of 0 signifies no relationship between their movements. Typically, investors seek to understand these correlations to optimize their portfolios and hedge against risks.

Factors Influencing Correlation

The relationship between cryptocurrency markets and traditional financial markets is influenced by a variety of factors, including economic indicators, market sentiment, and macroeconomic events. For instance, when the stock market experiences a downturn due to geopolitical tensions or economic data releases, investors often flock to cryptocurrencies as a perceived safe haven. This dynamic can create a positive correlation between the two markets in specific contexts.

Market Sentiment and Its Effects

Market sentiment plays a significant role in shaping the correlation between cryptocurrencies and traditional assets. During times of optimism, both crypto and stock markets may rise in unison as investors feel confident in their investments. Conversely, during periods of fear or uncertainty, a sell-off in stock markets can also trigger a similar reaction in crypto markets, although this correlation is not always consistent over time.

The Role of Institutional Investment

In recent years, the entry of institutional investors into the crypto markets has heightened the correlation between digital and traditional markets. Institutions often adopt a diversified approach, operating across various asset classes, which can lead to synchronized movements between these markets. As institutional interest in cryptocurrencies grows, their activities significantly impact pricing and correlations, often following trends observed in stock or bond markets.

Statistical Analysis: Correlation Studies

Many studies have attempted to quantify the correlation between cryptocurrency and traditional markets using statistical models. For example, researchers frequently utilize correlation coefficients and regression analysis to determine how closely linked these markets are. Recent findings suggest that while cryptocurrencies have historically exhibited a low correlation with traditional assets, increasing participation from institutional investors is prompting a shift toward a more correlated behavior.

Case Studies: Bitcoin vs. Stock Market

Bitcoin, as the leading cryptocurrency, serves as a primary case study in exploring market correlations. During significant market events, such as the COVID-19 pandemic’s onset in early 2020, Bitcoin’s prices initially dropped alongside the stock market. However, in the months that followed, Bitcoin’s recovery outpaced that of traditional stocks, indicating a complex and evolving relationship between these markets.

Risk Management Strategies

Investors must consider correlation when developing risk management strategies. Diversifying across asset classes with low or negative correlations can provide a buffer against market volatility. Understanding the nuances of the crypto market’s correlation with traditional markets allows investors to make informed decisions and better manage their portfolios.

Predictions for the Future

As the crypto markets continue to mature, the nature of their correlation with traditional markets is likely to evolve. Factors such as regulatory developments, technological advancements, and market adoption will all play crucial roles in shaping these dynamics. Analysts predict that as cryptocurrencies gain more legitimacy, we may see increased integration with traditional financial systems, potentially leading to stronger correlations.

Conclusion

The correlation between crypto markets and traditional financial markets is multifaceted and continuously changing. While cryptocurrencies have often been seen as a safe haven independent of the stock market, macroeconomic factors and investor behavior can create varying degrees of correlation. Understanding these dynamics is vital for any investor looking to navigate the complexities of modern financial markets and make sound investment decisions.